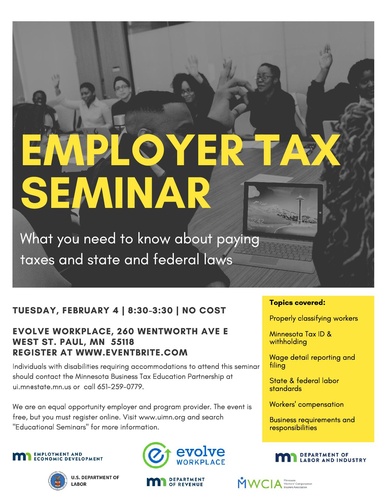

Employer Tax Seminar: Employer Responsibilities

The Minnesota Business Tax Education Partnership is holding a seminar in West St. Paul, Minnesota for employers and their representatives who are interested in information on state and federal employment taxes and other employer responsibilities. This seminar will be presented by experts from the Minnesota Department of Revenue, Minnesota Unemployment Insurance Program, the United States Department of Labor, the MN Department of Labor and Industry and the MN Workers’ Compensation Insurers Association.

The seminar content will include information on:

- Worker status (independent contractor vs employee)

- Employment Tax basics (withholding, depositing and reporting)

- Unemployment Insurance (tax rates, wage reporting, benefit account issues)

- State & Federal Labor Standards (Wage & Hour)

- Workers’ Compensation Information and Requirements

Date and Time

Tuesday Feb 4, 2020

8:30 AM - 3:30 PM CST

Location

Evolve Workplace

260 Wentworth Ave E

West St. Paul, MN 55118

Fees/Admission

FREE to attend

Registration is required

Website

Contact Information

Catherine Peregrino

Send Email